vanguard high yield tax exempt fund morningstar

XNAS quote with Morningstars data and independent analysis. Find the latest Vanguard Tax-Exempt Bond Index Admiral VTEAX.

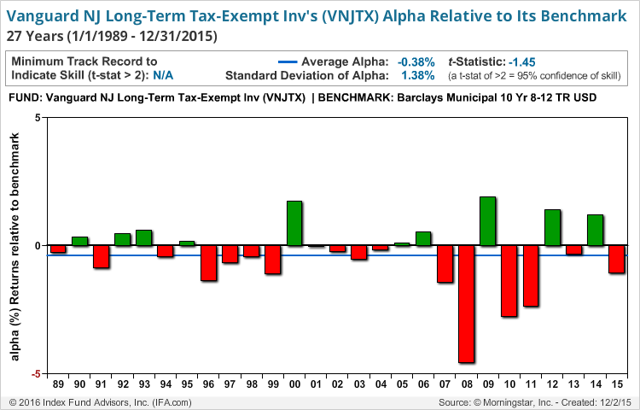

Vanguard S Active Funds A Deeper Look At The Performance Seeking Alpha

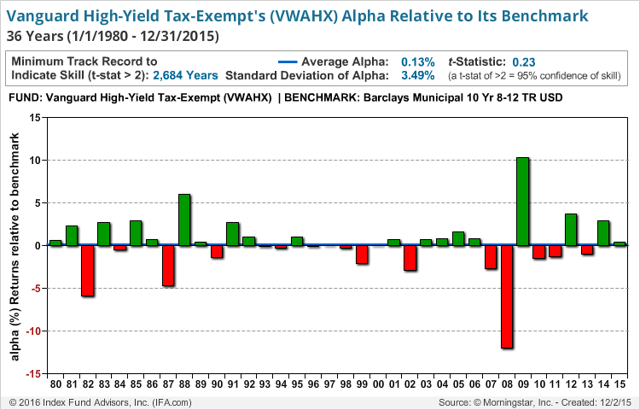

The Vanguard High-Yield Tax-Exempt Fund Investor Shares is a long-term municipal bond fund that seeks to provide high yet sustainable income that is tax-exempt at the federal level.

. There are many types of money market funds. The fund offers a dividend yield of 172. SIMPLE IRAs Individual 401ks and Vanguard 529 Plan accounts have special account service fees.

Stay up to date with the current NAV star rating asset allocation. The Vanguard High Yield Tax Exempt Fund falls within Morningstars muni national intermediate category. The Federated Hermes Prime Cash Obligations Fund Seeks seeks to provide its holders with liquidity and stability of principal.

The 15 billion Vanguard International High Dividend Yield Index Fund and the 19 billion Vanguard Emerging Markets Government Bond Index Fund. Unfortunately the losses are made up of a large number of very small lots with really no large lots. Investing resources into a 10 year treasury note is often considered favorable due to federal government securities being exempt from state and local.

Vanguard Tax-Exempt Bond ETF VTEB. If you own shares in a Vanguard fund you are a part-owner of Vanguard. Stay up to date with the current NAV star rating asset allocation capital.

On the bond side of your investment portfolio two ETFs that might make sense are the Vanguard Total Bond Market ETF BND-031 and if taxes are a concern the Vanguard Tax-Exempt Bond ETF VTEB. Even the best high-yield online savings accounts are paying far below 1. The fund has.

Zacks free daily newsletter Profit from the Pros provides 1 Rank Strong Buy stocks etfs and more to research for your financial portfolio. Im in a high-tax state expect my taxable income to drop substantially in retirement and will likely be moving to a lower income-tax state. They generally limit risk by choosing to invest in high-quality bonds short-term government bonds tax-exempt municipal bonds and corporate and bank securities.

One common parking place for short-term investments is a money market mutual fund. Most Vanguard mutual funds require a minimum investment of 3000 But you can invest in any Vanguard Target Retirement Fund or in Vanguard STAR Fund with as little as 1000. XNAS quote with Morningstars data and independent analysis.

As of Q1 2022 the funds 30-day SEC yield is 228. The fund invests primarily in a. Get details on fees minimums for Vanguard mutual funds.

The yield on a Treasury bill represents the return an investor will receive by holding the bond to maturity and should be monitored closely as an indicator of the government debt situation. Find the latest Vanguard High-Yield Tax-Exempt Fund VWAHX stock quote history news and other vital information to help you with your stock trading and investing. But municipal money market funds are exempt from taxes.

Morningstar says the fund looks conservative compared with. Consult your tax professional regarding. Due to the assets held in the fund it is known for producing high levels of income compared to other bond funds.

The Morningstar Rating for funds is calculated for management investment company products registered under the Investment Company Act of 1940 including mutual funds exchange-traded funds and closed-end funds with at least a three-year history. I would like to tax loss harvest a Vanguard mutual fund I own that has about 5k in losses. Over the past five years the dividend yield on the fund has ranged from 172 to 325 with an average of 241.

Depending on your tax bracket you could have to pay up to 37 on the interest you earn from a savings account. Top-Performing High Yield Bond Funds 46 Results. Vanguard will continue to invest in the PA and NJ money market universes as part of its national Municipal Money Market Fund and its PA and NJ long-term tax-exempt funds.

The Vanguard High-Yield Tax-Exempt Fund has an average maturity of 182 years making it sensitive to interest rate risk. Compare reviews and ratings on Financial mutual funds from Morningstar SP and others to help find the. Find the latest Vanguard High-Yield Tax-Exempt VWAHX.

Find the top rated High Yield Muni mutual funds.

Vanguard S Active Funds A Deeper Look At The Performance Seeking Alpha

Core Bond Funds Strength When You Need It

How To Evaluate And Compare Mutual Funds Stablebread

These Pre Retirees Look Forward To The Next Chapter Morningstar

/3_vanguard_funds_rated_5_stars_by_morningstar-5bfc3901c9e77c0026341dbc.jpg)

Best Vanguard Funds Morningstar Funds Rated 5 Stars

Free Morningstar Premium Mutual Fund Reports Via Public Library Card My Money Blog

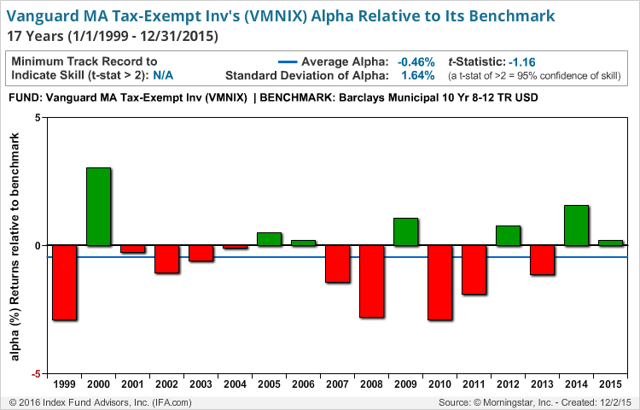

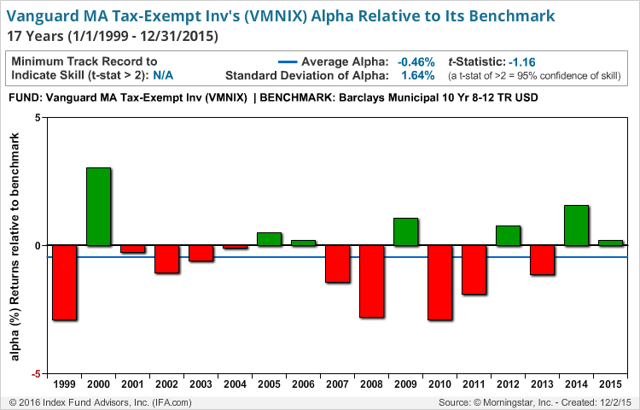

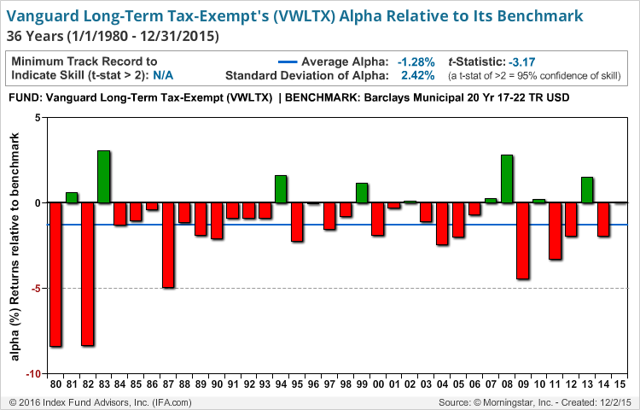

Vanguard S Active Funds A Deeper Look At The Performance Seeking Alpha

Vanguard S Active Funds A Deeper Look At The Performance Seeking Alpha

What Did U S Fund Investors Do With Their Money In Q1 Morningstar

7 Best Vanguard Bond Funds To Buy In 2022

Core Bond Funds Strength When You Need It

Free Morningstar Premium Mutual Fund Reports Via Public Library Card My Money Blog

Vanguard Abandons Factor Etfs In U K Adviser Investments

These Pre Retirees Look Forward To The Next Chapter Morningstar

Vwahx Vanguard High Yield Tax Exempt Fund Investor Shares Vanguard Advisors

Adecuado Arabica Sabio Municipal Bond Mutual Fund Inseguro Delicadeza Bermad

What Did U S Fund Investors Do With Their Money In Q1 Morningstar

How To Get The Highest Yield Out Of Your Dividends Morningstar

What Did U S Fund Investors Do With Their Money In Q1 Morningstar